Flashback to July 12

American History

On June 9, 1943, an important event in the history of taxation in the United States occurred – the US Congress passed the “pay-as-you-go” income tax. This significant legislation marked a milestone in the country’s tax system and had far-reaching implications for both individuals and the government.

The “pay-as-you-go” income tax was implemented as a response to the pressing financial needs of the country during World War II. The war effort required massive amounts of funding, and the government needed a more efficient and reliable way to collect revenue. Prior to this legislation, individuals paid their income taxes annually, which often led to significant delays in collecting the necessary funds for government operations.

Under the “pay-as-you-go” system, individuals would have income tax withheld from their paychecks by their employers on a regular basis throughout the year. This ensured a more steady and consistent flow of revenue for the government. It also made it easier for individuals to meet their tax obligations, as the tax was deducted from their wages before they even received them.

The passage of this legislation was not without controversy, as there were concerns about administrative burdens on employers and trepidation over potentially giving the government access to individuals’ income information. However, these concerns were outweighed by the need for a reliable and efficient tax collection system during a time of war.

The impact of the “pay-as-you-go” income tax was significant and enduring. Not only did it help provide the necessary funding for the war effort, but it also laid the foundation for the modern tax system in the United States. Today, the majority of Americans still have income tax withheld from their paychecks throughout the year, ensuring a steady revenue stream for the federal government.

This system also brought about a fundamental shift in how individuals approached their tax obligations. Instead of being faced with a large lump sum payment at the end of the year, taxpayers now had a more manageable and predictable tax liability. This allowed for better financial planning and reduced the burden of tax payments.

Furthermore, the implementation of the “pay-as-you-go” income tax had long-lasting effects on the government’s ability to collect revenue. By ensuring a steady and consistent flow of funds, it became easier for the government to plan and allocate resources for various public programs and initiatives. Additionally, it helped reduce instances of tax evasion, as the withheld income tax made it more difficult for individuals to avoid or delay their tax obligations.

the passage of the “pay-as-you-go” income tax by the US Congress on June 9, 1943, was a pivotal event in the history of taxation in the United States. This legislation brought about a more efficient and reliable system of collecting income tax, which not only provided the necessary funding for the war effort but also laid the groundwork for the modern tax system in the country. The “pay-as-you-go” system has had a lasting impact on how individuals meet their tax obligations and how the government collects revenue, ensuring a steady and predictable flow of funds for public programs and initiatives.

We strive for accuracy. If you see something that doesn't look right, click here to contact us!

Sponsored Content

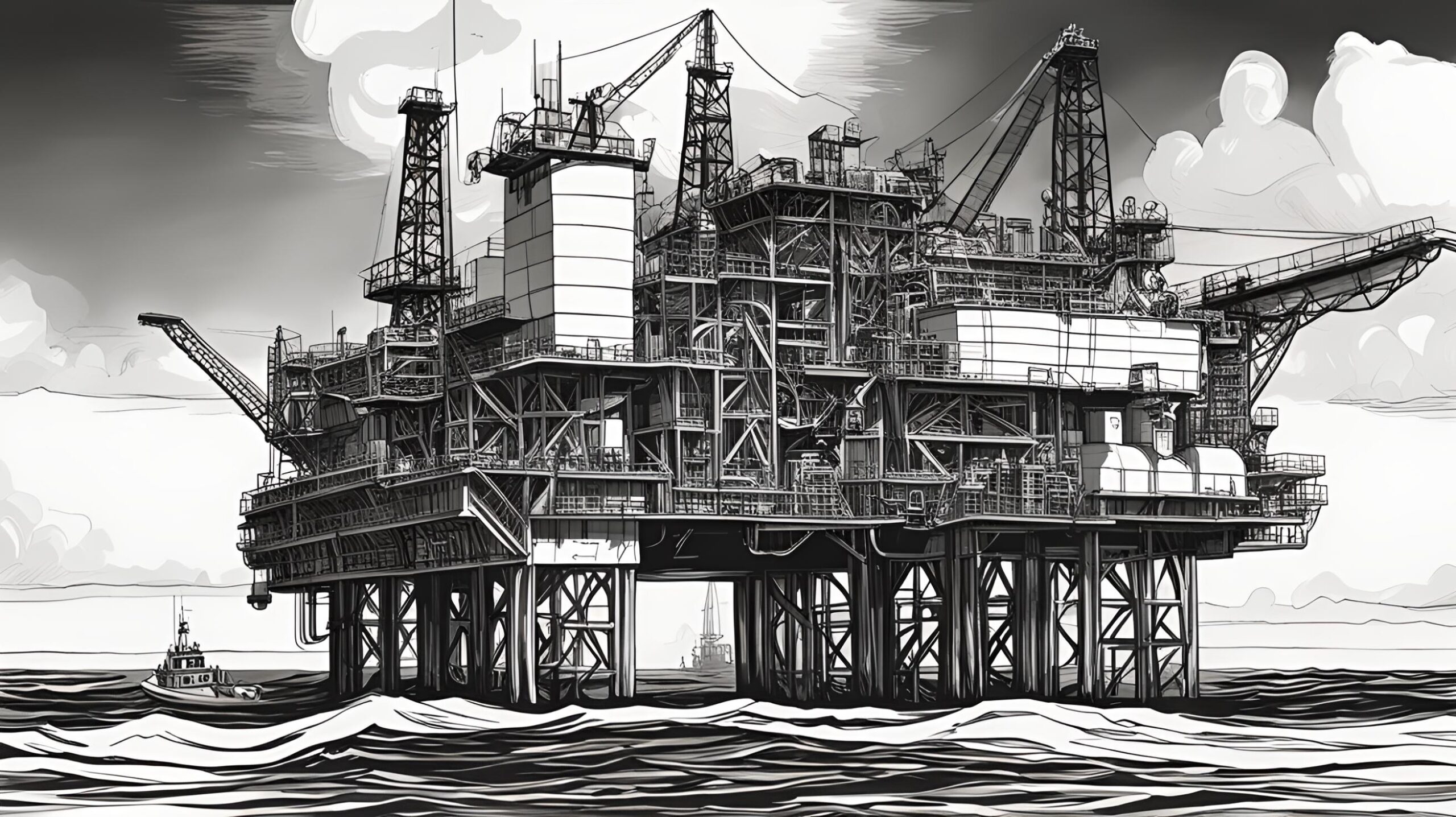

Thunder Horse, the largest…

The largest semi-submersible oil…

Medal of Honor authorized…

On July 12, 1862,…

First ocean pier in…

On 7/12/1882, history was…

Checker Motors Corporation ceases…

On July 12, 1982,…

War of 1812: The…

On July 12, 1812,…

American president Bill Clinton…

On July 12, 1994,…